the best scenario for refinancing

Youll break even on the closing costs in two years and. The best scenario for refinancing.

Is Now A Good Time To Refinance Your Mortgage Fox Business

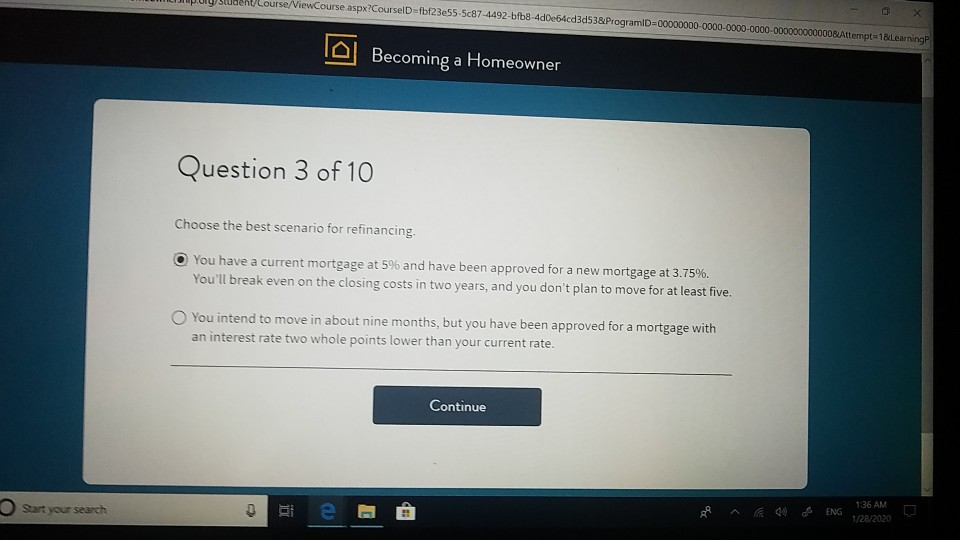

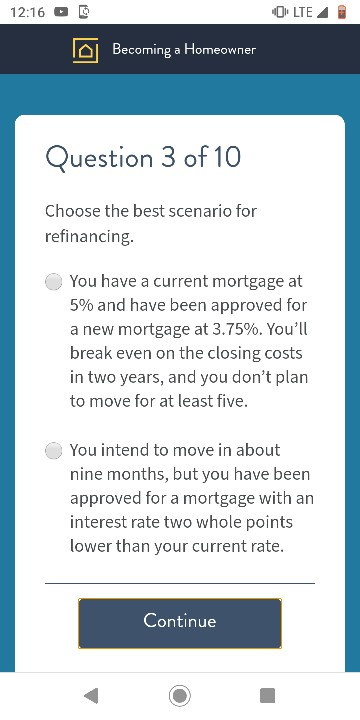

Choose the best scenario for refinancing.

. The best scenario for refinancing. A You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

You want to lower your interest rate. The best scenario for refinancing. The best scenario for refinancing is.

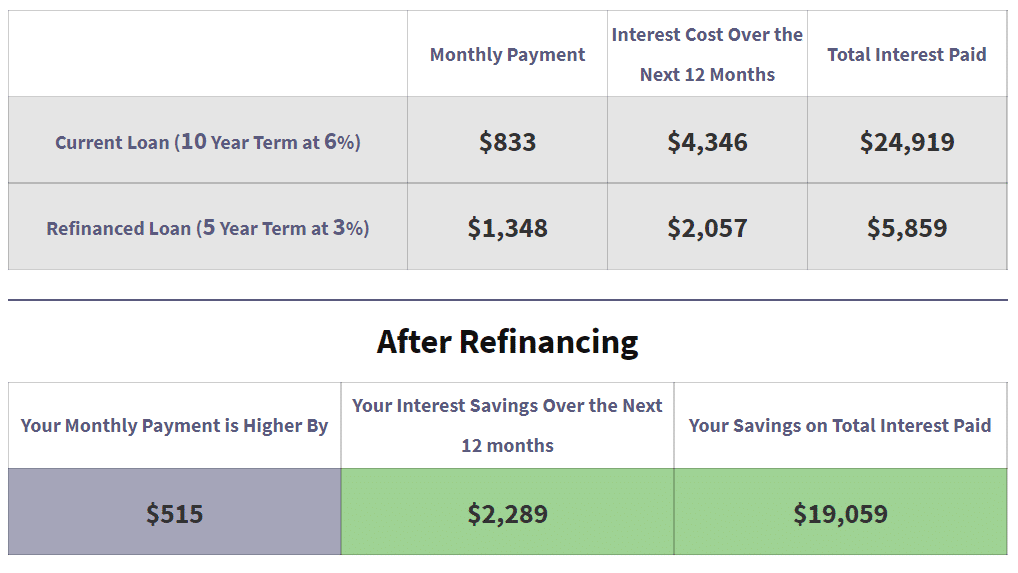

The lower interest rate drops your monthly payment from 1013 to. Best best Tips and References website. The best scenarios where you can win in refinancing written by union square awards applying for a mortgage refinance in utah is a popular way to reset the.

Question 3 Of 10 Choose The Best Scenario For Refinancing. But which one is the most important. By William K August.

Choose the best scenario for refinancing. Youll break even on the closing costs in two. Best Best Tips And References Website.

Question 3 of 10 choose the best scenario for. Closing costs Monthly savings Months to break even. The best scenario for refinancing isa.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. The best scenario for refinancing. The best scenario for refinancing.

The best scenarios where you can win in refinancing written by union square awards applying for a mortgage refinance in utah is a popular way to reset the clock of your home loan with a. The Best Scenario For Refinancing. Primarily multiple choice questions can have single select or multi select answer options.

Youll break even on the closing costs in two. Management indicated that they are going to refinance the obligation. You have a current mortgage at 5 and have been approved for a.

The best scenario for refinancing. The Best Scenario For Refinancing. For example you might want to switch from a 30-year mortgage to a 15-year one.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. The best scenario for refinancing. Make Your Overdraft Work For You.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing. Refinancing can be beneficial if you are near the end of an introductory rate period.

The best scenarios where you can. In this refi scenario then it would be almost three years before you got back the. For the first time since 1995 the central bank is.

Youll break even on the closing costs in. This is the actual example of a refinance assignment recently undertaken by us. Choose the Best Scenario for Refinancing.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. There are many factors to consider when refinancing your home loan. Best best scenario for.

Assume that at a 10 percent annual interest rate which is. 3125 95 33 months. A building is appraised at 1 million.

Youll break even on the closing costs in. Search anything about best Ideas in this website. An ideal scenario for conventional refinancing is a fico score above 700 and an ltv below 60 percent.

4 Good Bad Reasons To Refinance Your Home Mortgage Loan

Solved Vuiusuara Lourse Viewcourse Chegg Com

No Cash Out Refinance Vs Limited Cash Out Refinance Better Mortgage

3 Reasons To Refinance Even If You Already Have A Low Mortgage Interest Rate

Loan Modification Vs Refinancing How To Decide Sofi

A Retiree S Guide To Mortgage Refinancing Selfi

When Is Refinancing Worth It How Much Should Your Rate Drop

Choose The Best Scenario For Refinancing

When To Refinance Student Loans When Payments Restart In 2022 Student Loan Planner

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Americans Missed Out On 5 4 Billion By Not Refinancing Study Says Byu News

What Is A Cash Out Refinance How Does It Work Ally

Cash Out Refinance For Home Improvements Bankrate

Mortgage Refinancing Loan Programs In Houston Clear Lending

Is Now The Right Time To Refinance My Home Loan Homebridge Financial Services

Average Cost Of A Mortgage Refinance 3 398 The Ascent